Credit scores directly impact mortgage interest rates. A difference of just 100 points could cost, or save, you thousands. Without a high credit score, you won’t qualify for the best mortgage rates available, which could mean you’ll end up paying more money over the term of your mortgage. The difference between 3% and 3.25%, for example, can add up, especially if you’re applying for a 30-year fixed-rate mortgage.

Why your credit score matters to lenders

Along with a low debt to income ratio and a strong financial history, you’ll need a high credit score for the lowest mortgage rates. Why?

You’d probably hesitate to lend money to a friend who usually takes forever to pay you back — or doesn’t pay you back at all. Lenders feel the same way about mortgages. They want to lend to people who have a record of on-time payments to creditors.

Lenders rely on credit scores as an indication that a borrower will meet obligations. A higher credit score, experts say, reassures lenders that they will be paid back.

Your credit score is calculated most often with the FICO scoring model and is derived from the information on your credit reports, which are compiled by credit reporting companies. Your reports include a history of your payment habits with borrowed money.

Your credit score is “one of the most important parts to qualify, but it is a part,” says Michelle Chmelar, vice president of mortgage lending with Guaranteed Rate in New York. “You have to have the whole package: income, sufficient assets and credit.”

What credit score do you need for the best mortgage rate?

A credit score of 700-plus will usually land a borrower a lower interest rate, and while mortgage industry experts say you can still qualify for certain loans with a score under 680, the 700s are where you can expect to pay the lowest rates.

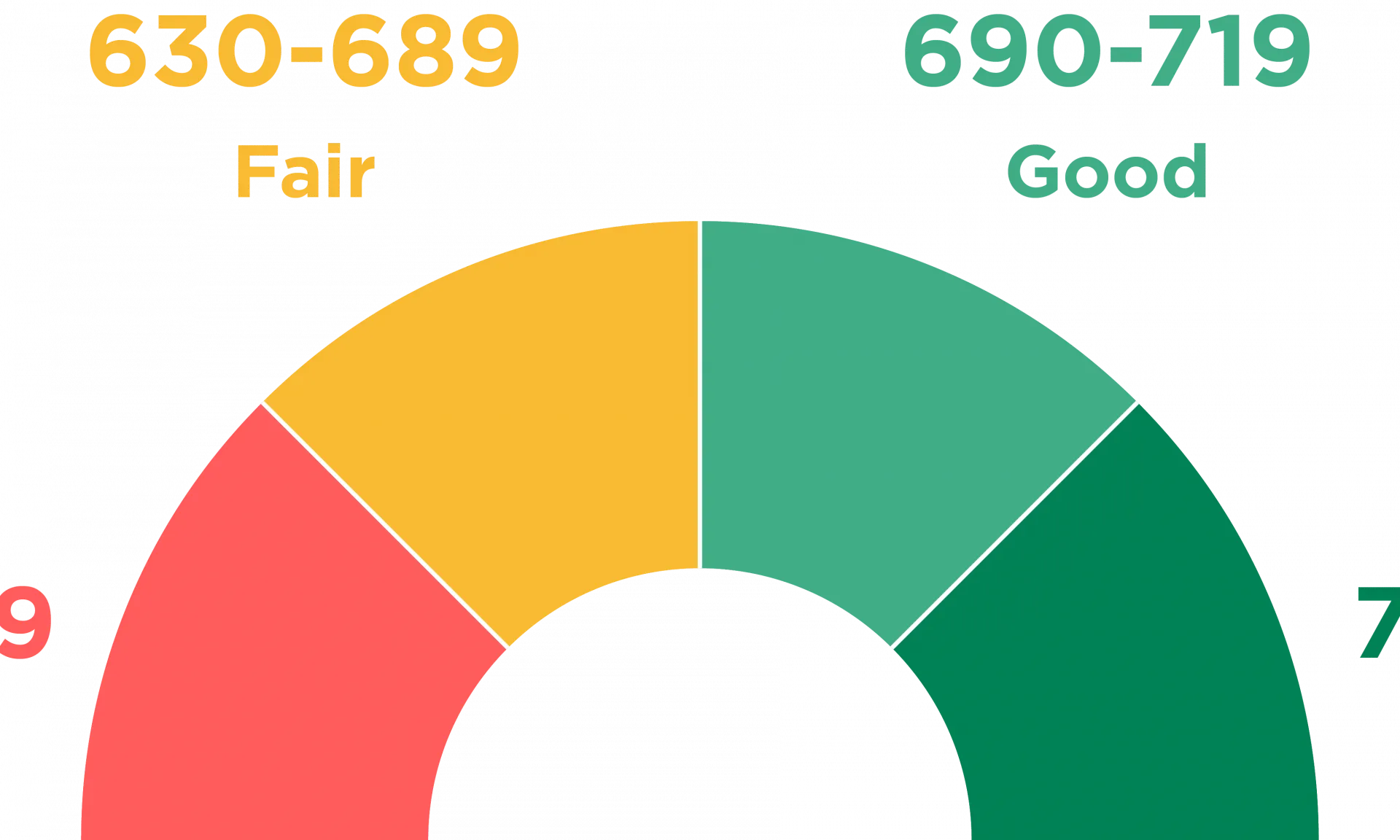

- A score of 740 or higher is generally considered excellent credit.

- A score between 700 and 739 is considered good credit.

- Scores between 630 and 699 are fair credit.

- And scores of 629 and below are poor credit.

The lending industry carves up the credit score scale into 20-point increments and adjusts the rates it offers borrowers each time a credit score moves up or down by about 20 points. For instance, if your score drops to 740 from 760, you’re likely to see a small bump up in the rate you’ll be offered.

How mortgage rates can vary by credit score

Let’s see how a 100-point difference in credit scores affects one woman’s mortgage payment.

For example, suppose a borrower looking to buy a home worth $300,000 has a 20% down payment and applies for a 30-year fixed-rate loan of $240,000. She has a 780 FICO credit score, which gets her a 4% rate. That’s around $1,164 a month, not including taxes, insurance or homeowners association fees.

If this borrower’s score dropped by about 100 points to between 680-699, her rate might increase to about 4.5%. At that interest rate, her monthly payment would increase to $1,216, an extra $62 a month, or $744 per year.

The effect of the difference in the rates may not seem significant at first, but added up over years, it could be a lot. In this example, a 100-point-drop has the borrower paying an additional $25,300 over 30 years.

At the same time, it’s important not to go crazy gaming your mortgage rate. If your score is already good, you should consider taking the rate you qualify for.

Industry professionals advise against taking too long to fine-tune an already-good credit score as rates could go up in the meantime and offset any benefit of a slightly higher score.

Mortgages where credit score matters less

With conventional loans — those backed by Fannie Mae and Freddie Mac a lot of focus is put on your credit score. says Dan Keller, a mortgage professional in Seattle.

The impact of a lower score won’t be as substantial on some types of loans as it would be with a conventional loan, Keller notes. For the best interest rates on a Federal Housing Administration or Department of Veterans Affairs loan, the focus isn’t on a 760 score as it is with conventional loans, he says; it’s on 700-plus.

- For an FHA loan you may be able to have a score as low as 500.

- VA loans don’t require a minimum FICO score, although lenders making va loans usually want a score of 620 or more.

- USDA loans backed by the Agriculture Department usually require a minimum score of 640.

So, there’s some leniency on credit scores and underwriting guidelines with government loans. But the loan fees are more expensive: You’ll have to pay mortgage insurance as well as an upfront and an annual mortgage insurance premium for an FHA loan.

But those credit score guidelines don’t tell the whole story. Most lenders have “overlays,” which are extra requirements or standards that allow them to require higher credit scores as a precaution.

How to build your credit score

Here are some of the best ways to build your credit score.

- Make payments, including rent, credit cards and car loans, on time.

- Keep your spending to no more than 30% of your limit on credit cards.

- Pay down high-balance credit cards and consider balance transfers to free up credit.

- Check for any errors on your credit report and work toward fixing them.

- Shop for mortgage rates within a 30-day period. Too many spread-out inquiries can lower your score.

- Work with a credit counselor or a lender to build your credit.

frequently asked questions (FAQs) about credit scores and their impact on mortgage rates

Your credit score is a critical factor in determining whether you qualify for a mortgage and the interest rate you’ll receive. A higher credit score generally leads to lower interest rates, saving you money over the life of your mortgage.

For the best mortgage rates, you’ll typically need a credit score of 700 or higher. Scores in the 700s are considered excellent credit, while scores between 630 and 699 are considered fair credit.

A 100-point difference in credit score can significantly impact your mortgage rate. For example, a drop from a score of 780 to 680-699 could result in an increase from 4% to 4.5% in interest rate, leading to higher monthly payments and thousands of dollars more paid over the loan term.

Government-backed loans like FHA or VA loans offer more leniency on credit scores compared to conventional loans. While they accept lower scores, borrowers may face higher fees such as mortgage insurance premiums.

Shopping for mortgage rates within a 30-day period allows multiple inquiries to count as a single inquiry on your credit report, minimizing the impact on your credit score.