Personal Loan Online

A Personal Loan is an unsecured loan that can be used to cover a variety of needs, including paying for a wedding, a vacation, unexpected medical costs, credit card debts, and more. These loans are easier to obtain and hassle-free because they don’t demand any security or collateral. A Personal Loan enables you to get instant access to a loan, as funds are generally disbursed immediately.

We offer instant personal loans with minimal documentation in a 100% paperless manner. Download TVS Credit Saathi App from Play Store or App Store, apply from the comfort of your home, from your preferred mobile device and get the loan amount required credited to your bank account.

Features and Benefits of Online Personal Loan

Instant approval

Install our Saathi app and apply for an amount of your choice from anywhere, anytime and get those funds transferred to your bank account on the same day.

Flexible Loan Amount and Tenure

Get easy EMI options and flexible repayment tenures of 6-60 months for a loan amount ranging from Rs. 50,000 to Rs. 5,00,000.

100% Paperless Process

No paperwork is required to avail a Personal Loan. From loan application to disbursements, the entire procedure is app-based.

Zero Documentation

Only basic details like PAN number, Aadhar Number and Address Proof are required to avail our personal loan.

Quick and Easy Application

Just provide a few basic details and verify the same to get the loan amount credited to your bank account without any hassle.

Personalised Assistance

Our digital assistant TIA is accessible at every step of this journey to ensure a seamless experience for you.

Charges on Online Personal Loans

| Other charges | |

|---|---|

| Bounce charges | Rs.0 – Rs.750 |

| Duplicate NDC/NOC charge | Rs.0 – Rs.500 |

For a complete list of charges, pleaseclick here

Get Personal Loan in a Few Easy Steps

02

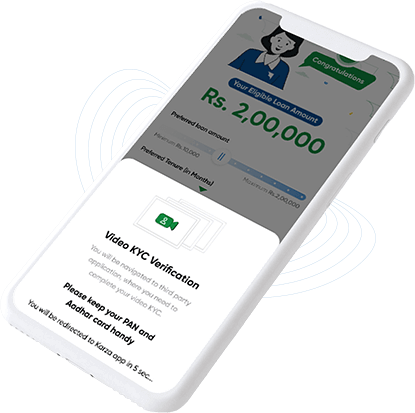

Verify your profile by updating your KYC details and check eligibility

03

Complete the video KYC process after choosing your loan amount & tenure

04

Confirm your bank details & complete the E-mandate process to get the loan disbursed

01

Download TVS Credit Saathi App and Sign up using your mobile number

Who can Apply?

Salaried Employees with income more than RS.25,000/- per month

Individuals with CIBIL Score more than 700

Keep these Details Handy

AadharNumber

AddressProof

PANNumber

Personal Loan EMI Calculator

Loan Amount

50K

₹ 50000₹ 7,00,000Rate Of Interest (p.a)

2%

2%35%Tenure (months)

6

6 Months60 Months

Monthly Loan EMI₹8,382

Principal Amount₹50,000

Total Interest Payable₹292

Total Amount Payable₹50,292

Disclaimer : These results are for indicative purposes only. Actual results may vary. For exact details, please contact us.

Finance Amount

₹ 50,000 to ₹ 5 Lakhs*

Rate of Interest / (APR)

16% to 35% Annualised ROI

Repayment Tenure

6 to 60 months

Processing Fees

2% to 6%

ILLUSTRATION

For ₹ 75,000/- borrowed at Interest rate’ of 2% p.m. for 12 months (interest rate on reducing balance method),the payable amount would be Processing fee’ ₹ 1500. Interest ₹ 10,103. The total amount to be repaid after a year will be ₹ 86,603.